Saturday, December 31, 2005

Cut and Paste

From the Associate Press

AP

Homebuilders Have Room to Rally in 2006

Friday December 30, 5:08 pm ET

By Vivian Chu, AP Business Writer

Homebuilders Have Room to Rally in 2006, Analysts Say, Despite Fears of a Slowdown

NEW YORK (AP) -- Rising interest rates, slowing home sales and cautious forecasts from some of the nation's biggest homebuilders are signs that a long-expected slowdown in the housing sector is under way.

But for all the talk of a housing bubble, many analysts don't foresee a crash-and-burn scenario for the industry's biggest players -- though few expect a return to the double-digit profit growth of previous years.

Homebuilders' stocks have been among Wall Street's best performers over the past several years, supported by historically low interest rates and blistering demand.

The Philadelphia Housing Sector Index, a gauge of 21 companies linked to the construction industry, reached a record high July 29, and more than doubled over the previous three-year period. The index is down about 10 percent since its peak.

Every week brings fresh evidence pointing to a slowdown. New home prices and the number of mortgage applications have been declining. Existing home sales in November slid 1.7 percent to an eight-month low, the National Association of Realtors said Thursday, while the government reported new home sales in the same month fell 11 percent, the biggest drop in nearly 11 years.

Homebuilding giants KB Home and Lennar Corp. said in December they were seeing a return to "more normalized" levels of activity after several years of outsized gains in sales and profits.

Despite the bearish data, many analysts still say that fears of a sharp downturn are overblown, and homebuilders have room to rally next year.

Wall Street maintains a bullish outlook on the biggest players. Analysts' average rating on the top five homebuilders measured by market capitalization ranges from "Strong Buy" and "Buy," according to financial research firm Thomson Financial.

One reason for the optimism is the fact that, despite their size, these companies have relatively small market share, and can expand their businesses even if the overall industry falters, said Jack Lake, an analyst for Cleveland-based Victory Capital Management.

Big homebuilders have large land holdings and can easily sell stock or debt to raise funds, whereas smaller players face higher financing costs and require more time to develop their land, Lake said.

"We're quite positive about homebuilders because the nation's 10 biggest builders only have 25 percent market share now, and over the next several years we expect them to gain share from smaller builders," Lake said. The last time new home sales declined, from 1999 to 2000, big homebuilders nonetheless reported double-digit growth in new home deliveries, he added.

Other analysts also believe large homebuilders have advantages over smaller, more highly leveraged outfits that will insulate them in a wider slowdown.

Recent data suggest new home sales will outperform existing home sales, a trend that would support business for the big players even if the industry cools, Citigroup analyst Stephen Kim wrote in a client note in early December.

"We believe speculations about the housing market's demise have been greatly exaggerated," Kim wrote. "The next downturn in housing will likely be far less severe for the public homebuilders than the industry at large." These companies are "significantly undervalued," Kim wrote, even assuming a "draconian" downturn.

Industry executives insist they will be able to post sharply higher profits for several more years, citing their large backlogs -- or homes that have been sold, but not yet built. Analysts say demand from baby boomers wanting vacation homes, recent immigrants and first-time buyers will keep fueling demand over the next decade.

Yet, a growing chorus on Wall Street argues that homebuilders are like any other cyclical industry, and due for a pullback after nearly five years of frenzied growth.

"I would say the environment for homebuilders is going to be a lot more challenging, based on decreased demand, price appreciation and increase for land labor and materials costs," Bank of America analyst Daniel Oppenheim said.

Given consumers' already high levels of debt, even a slight increase in interest rates will dampen demand, the analyst added. Bank of America projects the 10-year Treasury note, a key benchmark for mortgage loans, will rise 0.60 percent next year, up from a current 4.39 percent.

"Homebuyers are stretched enough as it is, and they're going be sensitive to modest changes in interest rates," he said. Inventory of homes for sale is also at an all-time high, which will hurt homebuilders' ability to raise prices and pressure profit margins next year, he added.

Still, the thought of rising rates and other bearish data doesn't deter bulls like Victory's Lake.

Victory, which manages assets of $55 billion, began buying shares of Lennar and Pulte Homes Inc. in September, and has added to its holdings in both ever since. The fund currently owns about 723,000 shares of Lennar and 1.03 million Pulte shares, he said.

The price drop in homebuilder stocks since their peak in July doesn't bother him. "We liked that decline, since we saw it as a good opportunity to buy," he said.

AP

Homebuilders Have Room to Rally in 2006

Friday December 30, 5:08 pm ET

By Vivian Chu, AP Business Writer

Homebuilders Have Room to Rally in 2006, Analysts Say, Despite Fears of a Slowdown

NEW YORK (AP) -- Rising interest rates, slowing home sales and cautious forecasts from some of the nation's biggest homebuilders are signs that a long-expected slowdown in the housing sector is under way.

But for all the talk of a housing bubble, many analysts don't foresee a crash-and-burn scenario for the industry's biggest players -- though few expect a return to the double-digit profit growth of previous years.

Homebuilders' stocks have been among Wall Street's best performers over the past several years, supported by historically low interest rates and blistering demand.

The Philadelphia Housing Sector Index, a gauge of 21 companies linked to the construction industry, reached a record high July 29, and more than doubled over the previous three-year period. The index is down about 10 percent since its peak.

Every week brings fresh evidence pointing to a slowdown. New home prices and the number of mortgage applications have been declining. Existing home sales in November slid 1.7 percent to an eight-month low, the National Association of Realtors said Thursday, while the government reported new home sales in the same month fell 11 percent, the biggest drop in nearly 11 years.

Homebuilding giants KB Home and Lennar Corp. said in December they were seeing a return to "more normalized" levels of activity after several years of outsized gains in sales and profits.

Despite the bearish data, many analysts still say that fears of a sharp downturn are overblown, and homebuilders have room to rally next year.

Wall Street maintains a bullish outlook on the biggest players. Analysts' average rating on the top five homebuilders measured by market capitalization ranges from "Strong Buy" and "Buy," according to financial research firm Thomson Financial.

One reason for the optimism is the fact that, despite their size, these companies have relatively small market share, and can expand their businesses even if the overall industry falters, said Jack Lake, an analyst for Cleveland-based Victory Capital Management.

Big homebuilders have large land holdings and can easily sell stock or debt to raise funds, whereas smaller players face higher financing costs and require more time to develop their land, Lake said.

"We're quite positive about homebuilders because the nation's 10 biggest builders only have 25 percent market share now, and over the next several years we expect them to gain share from smaller builders," Lake said. The last time new home sales declined, from 1999 to 2000, big homebuilders nonetheless reported double-digit growth in new home deliveries, he added.

Other analysts also believe large homebuilders have advantages over smaller, more highly leveraged outfits that will insulate them in a wider slowdown.

Recent data suggest new home sales will outperform existing home sales, a trend that would support business for the big players even if the industry cools, Citigroup analyst Stephen Kim wrote in a client note in early December.

"We believe speculations about the housing market's demise have been greatly exaggerated," Kim wrote. "The next downturn in housing will likely be far less severe for the public homebuilders than the industry at large." These companies are "significantly undervalued," Kim wrote, even assuming a "draconian" downturn.

Industry executives insist they will be able to post sharply higher profits for several more years, citing their large backlogs -- or homes that have been sold, but not yet built. Analysts say demand from baby boomers wanting vacation homes, recent immigrants and first-time buyers will keep fueling demand over the next decade.

Yet, a growing chorus on Wall Street argues that homebuilders are like any other cyclical industry, and due for a pullback after nearly five years of frenzied growth.

"I would say the environment for homebuilders is going to be a lot more challenging, based on decreased demand, price appreciation and increase for land labor and materials costs," Bank of America analyst Daniel Oppenheim said.

Given consumers' already high levels of debt, even a slight increase in interest rates will dampen demand, the analyst added. Bank of America projects the 10-year Treasury note, a key benchmark for mortgage loans, will rise 0.60 percent next year, up from a current 4.39 percent.

"Homebuyers are stretched enough as it is, and they're going be sensitive to modest changes in interest rates," he said. Inventory of homes for sale is also at an all-time high, which will hurt homebuilders' ability to raise prices and pressure profit margins next year, he added.

Still, the thought of rising rates and other bearish data doesn't deter bulls like Victory's Lake.

Victory, which manages assets of $55 billion, began buying shares of Lennar and Pulte Homes Inc. in September, and has added to its holdings in both ever since. The fund currently owns about 723,000 shares of Lennar and 1.03 million Pulte shares, he said.

The price drop in homebuilder stocks since their peak in July doesn't bother him. "We liked that decline, since we saw it as a good opportunity to buy," he said.

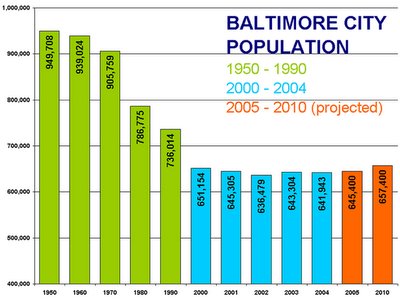

The Great Migration

I love this chart!!!!!

We all hear the talk about our booming real estate property values in the burbs.

Ever wonder why the burbs bloom to such heights?

Checkout the city population trend and see for yourself.

when the baby boomers were coming of the age to buy their first property a migration trend began that gutted the cities of it's people and real estate value.

Once they were done moving out, The city recovered by knocking down abandon houses and putting up new offices buildings and parks.

I do have a blog promoting Baltimore as a place to live. I believe it is a shelter of the storm that the burbs are about to get hit with.

The first baby boomers just hit 60. It's time for them to start moving again.

I believe Toll Brother, Beazer Homes and all the others will be ready for them with new homes out on the lake, the woods, the mountains, the golf resort, and so on.

It's coming.

Housing Starts

What's all the talk about housing starts? I look at the chart and for the life of me can not see how based on the volatility of the chart a person can jump to any conclusions from a one month change.

The numbers are just to erratic. But check the trend and see where it is going. And of course keep in mind that baby boomers are now 60 years old with retirement and housing needs changing in the near future for them.

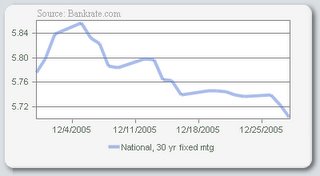

Look out Below

These blog sites are filled with experts telling you about the rising interest rates. We also have experts at Forbes, Fox News, CNBC, and every co-worker, family memeber, friend, and neighbor.

The facts are what the facts are though.

Long term borrowing cost are dropping, not rising.

The inverted yeild curve that all the expert jumped on the band wagon recently with 'this is the end for housing' crap, reflects a dive in the long term cost not a spike in the short term. They have the situation backwords in all their analysis!!! Well at least Forbes does. Their logic is that short term rates spiked above long term rates, and long terms rates will quickly correct itself. The truth is long term rates dropped below short term rates, and short term rates will quickly correct itself.

Look at the real effect on mortgage rates. They are diving, not spiking up.

Subscribe to Comments [Atom]