Saturday, December 31, 2005

Look out Below

These blog sites are filled with experts telling you about the rising interest rates. We also have experts at Forbes, Fox News, CNBC, and every co-worker, family memeber, friend, and neighbor.

The facts are what the facts are though.

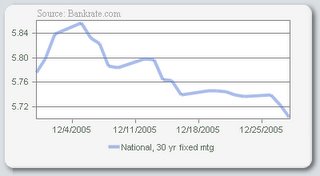

Long term borrowing cost are dropping, not rising.

The inverted yeild curve that all the expert jumped on the band wagon recently with 'this is the end for housing' crap, reflects a dive in the long term cost not a spike in the short term. They have the situation backwords in all their analysis!!! Well at least Forbes does. Their logic is that short term rates spiked above long term rates, and long terms rates will quickly correct itself. The truth is long term rates dropped below short term rates, and short term rates will quickly correct itself.

Look at the real effect on mortgage rates. They are diving, not spiking up.

Subscribe to Comments [Atom]