Thursday, December 29, 2005

www.TheStreet.com

A lot of people hate these guys. I know I don't alway like to hear what they have to say. But unlike the clowns at Forbe, The Street.com does not wait for the popular view, they do not write their opinions base on public preception with the intentions of gaining readers by stroking the egos of morons that will nod their head in agreement as they see all their views in print.

I don't agree with everything Cramer has to say, but at least he is a free thinker that can make sound rationalaztions based on the raw facts as presented, rather than another chaser of the current hype.

How Stocks Win on Housing Buildup

By James J. Cramer

RealMoney.com Columnist

12/29/2005 11:51 AM EST

The single most bullish thing about stocks I know is that existing inventory of unsold homes hit another new high today.

While we haven't felt the impact yet -- which will be a decline in price of houses, not the number of them sold -- owing to the inability of homeowners to compute that the asset may not be going up anymore, it is the story to watch in 2006. Because the "headline" competition from real estate is withering, and that's what matters.

In any given market, there are marginal buyers who supply the fuel to move inventory at higher prices. We have lacked those marginal buyers in stocks for six years. They all got crushed in 2000-2001 and then went to real estate, which had the same "can't miss" characteristics of Webvan and E-Toys, although you can live in your home after it goes down, but you can't live in those stock certificates. Now those marginal buyers, deep into real estate, are reading uncomfortable headlines and are beginning to get nervous, the first step toward cutting price to move.

We have the biggest supply of unsold homes in 20 years, but we are a huge growth economy -- people always act as if we are some sort of Switzerland-meets-Belgium, when our growth -- legal and illegal -- is more akin to Third-World growth than First-World. So that increase in supply hasn't tipped anything yet. Think about it: We had 240 million people living here in 1986; now there are 300 million. That we would freak out about the same inventory number, given the huge gain in the denominator, is absurd!

But if rates keep going up -- a given, I believe -- and if immigration gets shut down -- a possibility, albeit slim -- we are going to have an adjusted unsold inventory number that, sometime in 2006, could drive those marginal buyers to turn sellers and turn to the stock market.

It is a work in progress, because I believe in a soft landing, again because of the population growth. If anyone in the media actually bothered to think about the population growth before jumping on the "highest unsold inventory in 19 years" headline, they'd know why Toll (TOL:NYSE - commentary - research - Cramer's Take) and Lennar (LEN:NYSE - commentary - research - Cramer's Take) aren't going down and why Beazer (BZH:NYSE - commentary - research - Cramer's Take) and KB (KBH:NYSE - commentary - research - Cramer's Take) are such great stocks still. But that involves going to Google, getting the population of 1986 and getting the population now, and, alas, that's not in the cards for the people who write these stories.

Still, watch this story. If the unsold inventory number grows by 25%, then I believe we will be in a situation that will be extremely bullish for stocks: Lower short-term rates and a price-to-earnings ratio that could be mouth-watering to those median performance--chasing hounds who determine so much about what area is hot for investment.

I don't agree with everything Cramer has to say, but at least he is a free thinker that can make sound rationalaztions based on the raw facts as presented, rather than another chaser of the current hype.

How Stocks Win on Housing Buildup

By James J. Cramer

RealMoney.com Columnist

12/29/2005 11:51 AM EST

The single most bullish thing about stocks I know is that existing inventory of unsold homes hit another new high today.

While we haven't felt the impact yet -- which will be a decline in price of houses, not the number of them sold -- owing to the inability of homeowners to compute that the asset may not be going up anymore, it is the story to watch in 2006. Because the "headline" competition from real estate is withering, and that's what matters.

In any given market, there are marginal buyers who supply the fuel to move inventory at higher prices. We have lacked those marginal buyers in stocks for six years. They all got crushed in 2000-2001 and then went to real estate, which had the same "can't miss" characteristics of Webvan and E-Toys, although you can live in your home after it goes down, but you can't live in those stock certificates. Now those marginal buyers, deep into real estate, are reading uncomfortable headlines and are beginning to get nervous, the first step toward cutting price to move.

We have the biggest supply of unsold homes in 20 years, but we are a huge growth economy -- people always act as if we are some sort of Switzerland-meets-Belgium, when our growth -- legal and illegal -- is more akin to Third-World growth than First-World. So that increase in supply hasn't tipped anything yet. Think about it: We had 240 million people living here in 1986; now there are 300 million. That we would freak out about the same inventory number, given the huge gain in the denominator, is absurd!

But if rates keep going up -- a given, I believe -- and if immigration gets shut down -- a possibility, albeit slim -- we are going to have an adjusted unsold inventory number that, sometime in 2006, could drive those marginal buyers to turn sellers and turn to the stock market.

It is a work in progress, because I believe in a soft landing, again because of the population growth. If anyone in the media actually bothered to think about the population growth before jumping on the "highest unsold inventory in 19 years" headline, they'd know why Toll (TOL:NYSE - commentary - research - Cramer's Take) and Lennar (LEN:NYSE - commentary - research - Cramer's Take) aren't going down and why Beazer (BZH:NYSE - commentary - research - Cramer's Take) and KB (KBH:NYSE - commentary - research - Cramer's Take) are such great stocks still. But that involves going to Google, getting the population of 1986 and getting the population now, and, alas, that's not in the cards for the people who write these stories.

Still, watch this story. If the unsold inventory number grows by 25%, then I believe we will be in a situation that will be extremely bullish for stocks: Lower short-term rates and a price-to-earnings ratio that could be mouth-watering to those median performance--chasing hounds who determine so much about what area is hot for investment.

The news that is too Big for a Forbes reporter to grasp

The Japanese equivalence of our ten year notes are trading at 1.5%

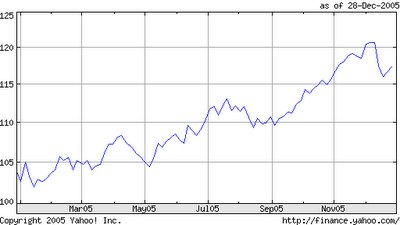

Checkout the chart to see how our dollar is gaining strength on the Yen.

Put the two together. A Jap has two choices 1) by his notes and get a 1.5% rate of return, or 2) buy our notes and get a 13% rate of return after combining dollar momentum with our notes rate of return.

Will he buy our or his, hmmm....

If he buys so many of our notes that the Ten year treasuries drop to 2%. Will he still buy more?

The interest rate on a ten year note will fall, not rise

Mortgage rates will fall, not rise.

Subscribe to Comments [Atom]