Sunday, November 19, 2006

Get ready for a crazy ride

Every now and then I have to trade my Toll Brothers stock that time is coming. Looking to sell on Tuesday and buy back a week from Wendsday.

Once again the media is our self proclaim expert on what's going on in the market. Never mind the fact that they got their jobs because they know how to spell, not because they know how to think. It has just been a coincidence that grammar challenge idiot blogger predicted rates would be lower by the end of 2006 when the entire media was predicated a massive interest rate rally. These things aren't important. We still post their stories as "proof" of our thoughts.

Here is what happened to home builders during our nice 12% rally. On this blog the surge in mortgage applications was predicted when mortgage rates rose versus falling with the economic factors OTHER THAN SUPPLY AND DEMAND. There was a two week delay in the reporting of the application increase from when we saw the mortgage rates rise and when we got our first pop in mortgage applications. It does take time, or do the banks just see the informal process in terms of a flood of phone calls first?

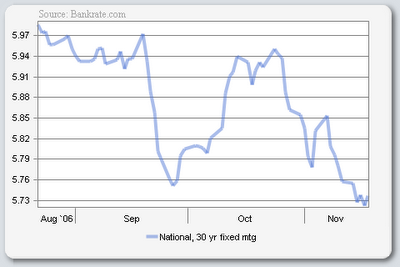

Two weeks ago the Bank of England raised it's rates. Normally our mortgage rates would rise in symphony. They fell that day. Supply and demand drove the rates before. Supply and demand was at it again.

Since then the economics behind mortgage rates other than supply and demand have all been pressuring rates lower, so it is harder to see the impact of supply and demand. But rates have fallen fast and hard.

The market wants a third week of mortgage application increase to surge forward. It will forgive the minor correction in applications this up coming week. It will not want to see the proof that the correction my be the new trend. I will likely buy back on that week. A week from Wensday.

Subscribe to Comments [Atom]